We asked our Co-Founder and CTO to predict which trends will have the biggest impact on community banks and credit unions in 2022 and beyond. Here’s what he told us.

1. Smaller banks will embrace open banking technology to remain competitive.

Widely utilized overseas, the global open banking market is forecast to grow to $43.15 billion by 2026, boosted by a surge in adoption of new applications and services. Open banking is poised to make a significant impact in the U.S. because it opens the door for many opportunities that can benefit consumers, fintechs, and, most importantly, financial institutions grappling with digital transformation. Open banking can democratize the digital experience and empower smaller financial institutions (FIs) to compete with the top-five banks. In 2022, we’ll see community banks and credit unions partner with fintech companies who use open source technology responsibly and effectively to overcome their legacy infrastructure challenges and provide better digital experiences at a lower cost of maintenance and development. This includes utilizing the vast amount of online data to quickly verify customer information, enabling easier account funding through instant account verification (IAV), and real-time reading and writing to the core to eliminate batch processing. Smaller banks that embrace innovation and harness the power of open banking will be well-positioned for future growth and resilience.

2. Investments in data analytics will drive growth and inform strategy.

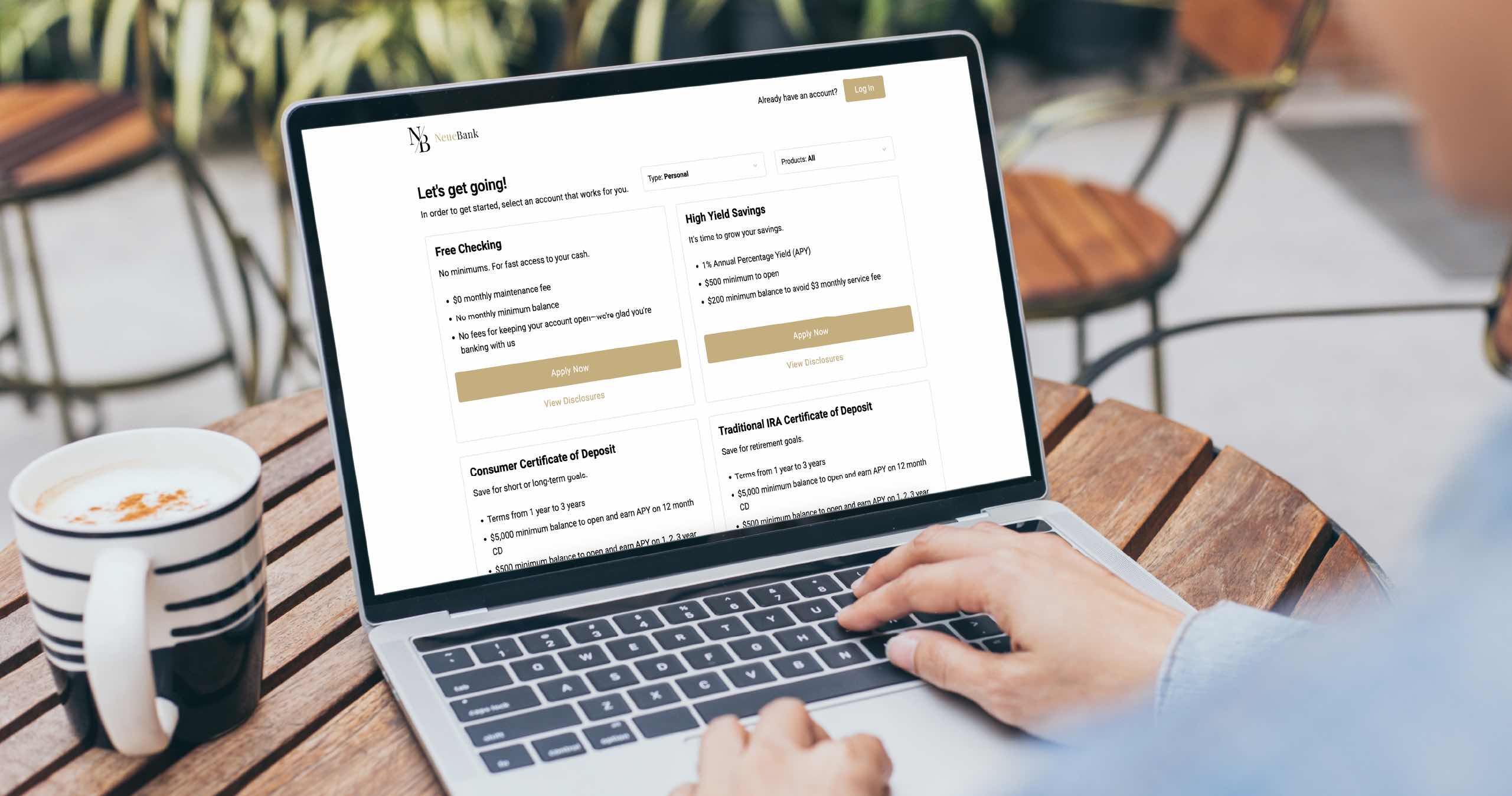

Historically, bankers have been reluctant to embrace technology innovation because it is viewed as an expense rather than an investment. Burgeoning data collection opens the door to utilizing customer data in meaningful ways and we’ll see more banks adopt data analytics technologies to inform strategy—identifying new markets, product offerings, and potential customers. Data plays a critical role in helping financial institutions build trust with customers, from retention and activation to attraction and onboarding. In particular, it’s crucial banks and credit unions leverage data to optimize the onboarding process. Modern KYC systems can reduce friction and manual input during the onboarding process with augmented backend customer data, creating a streamlined onboarding process that converts more customers and builds strong relationships at the first touchpoint. Success will be found by financial institutions that invest in technologies that help them grapple with all of this data now.

3. Incumbent banks must adopt a microservices-based architecture—or risk falling behind.

The banking industry and U.S. financial system at large are lagging behind other industries pretty dramatically when it comes to software innovation. Software systems that are built on a microservices architecture benefit from receiving faster and more reliable updates and improvements, as well as higher degrees of scalability. This is why microservices-based architectures have become the industry standard for technology companies such as Google, Facebook, Netflix, and Microsoft. This is also why consumers are turning to neobanks and DeFis, which typically leverage a microservices-based architecture and offer significantly better customer experiences. Incumbent banks who want to improve time to market and gain the ability to quickly deliver new features and product updates to keep pace with neobanks must start adopting modern software development practices, like a microservices-based architecture, or risk falling behind.